Kimberly-Clark To Acquire Kenvue for $48.7 Billion

Image Credit : Wikimedia

Source Credit : Portfolio Prints

The Deal

Kimberly-Clark has entered into a binding agreement to acquire Kenvue in a cash and stock deal valued at approximately US$48.7 billion, based on the closing price of Kimberly-Clark common stock on October 31, 2025.

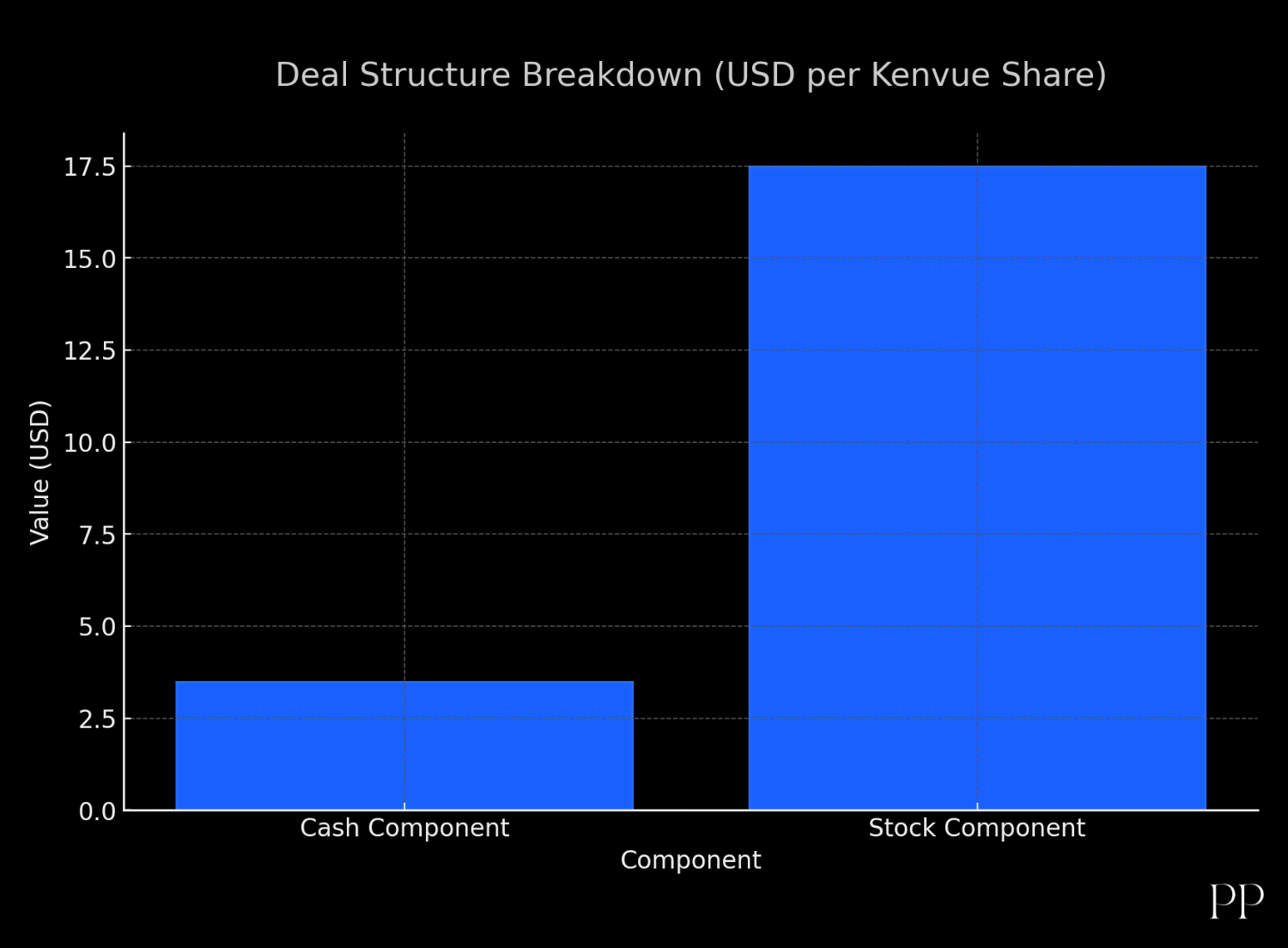

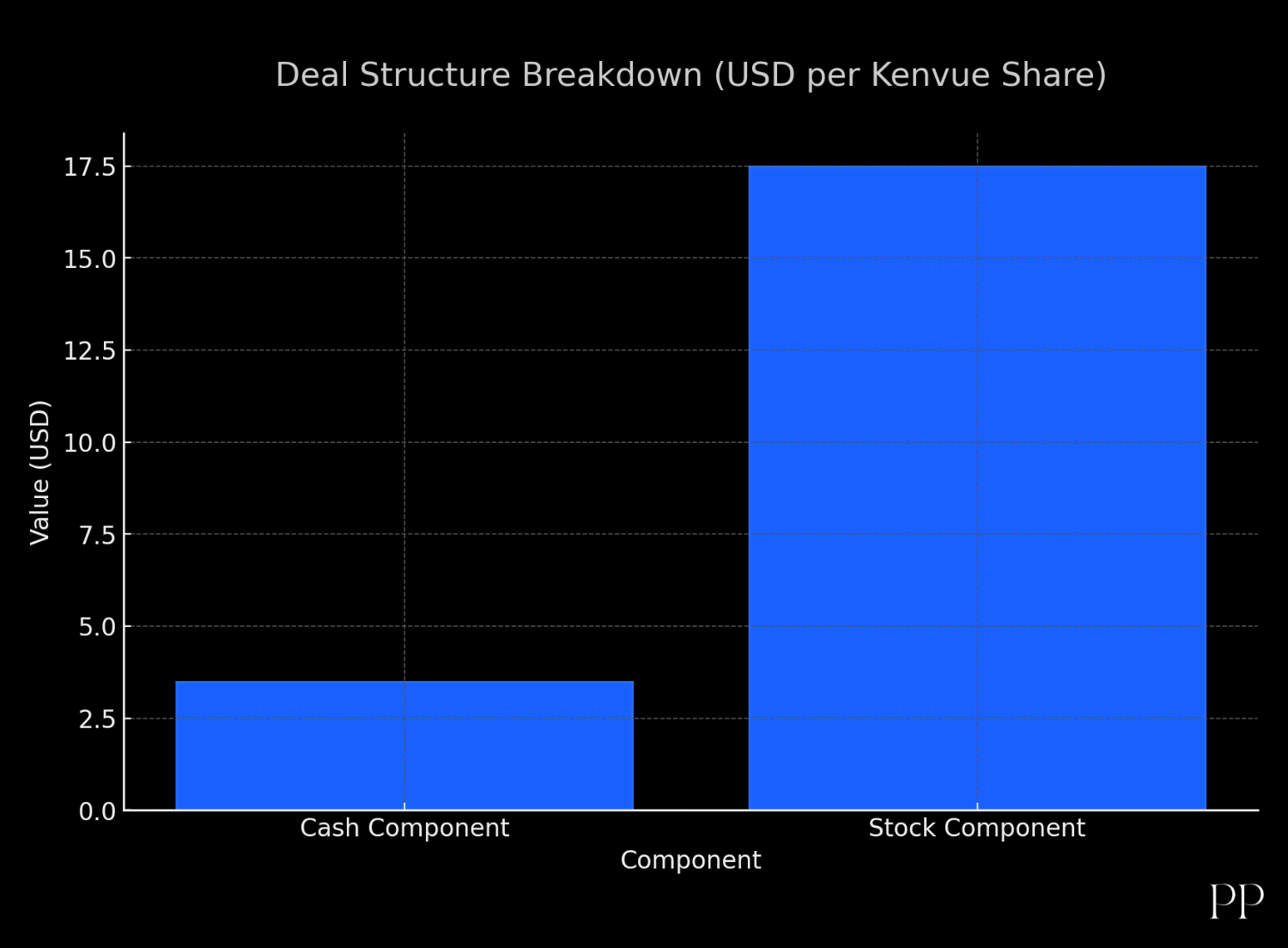

Under the deal’s structure, Kenvue shareholders will receive US$3.50 in cash per share and 0.14625 shares of Kimberly-Clark common stock for each Kenvue share held—equating to roughly US$21.01 per Kenvue share at Kimberly-Clark’s then‐share price.

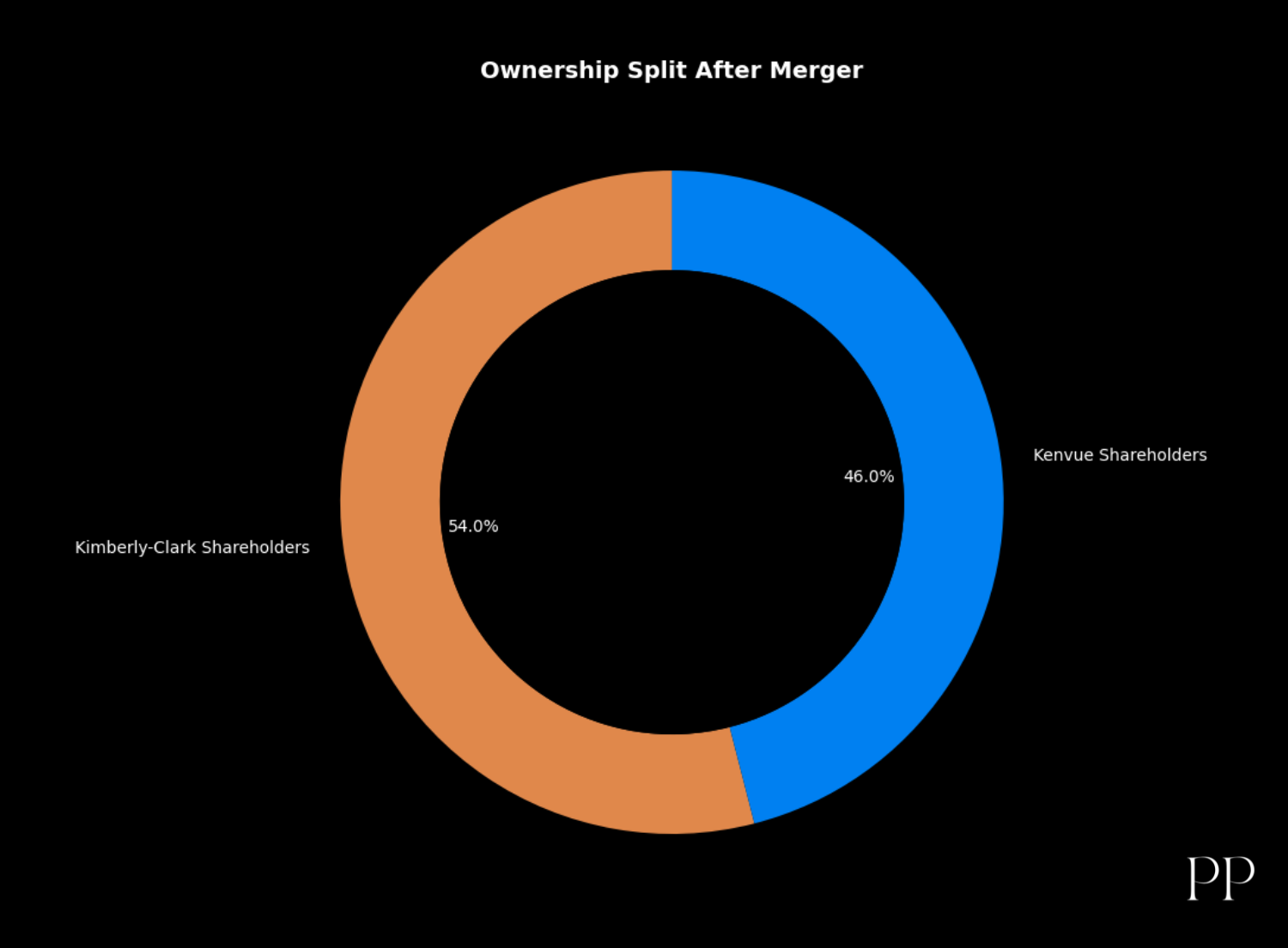

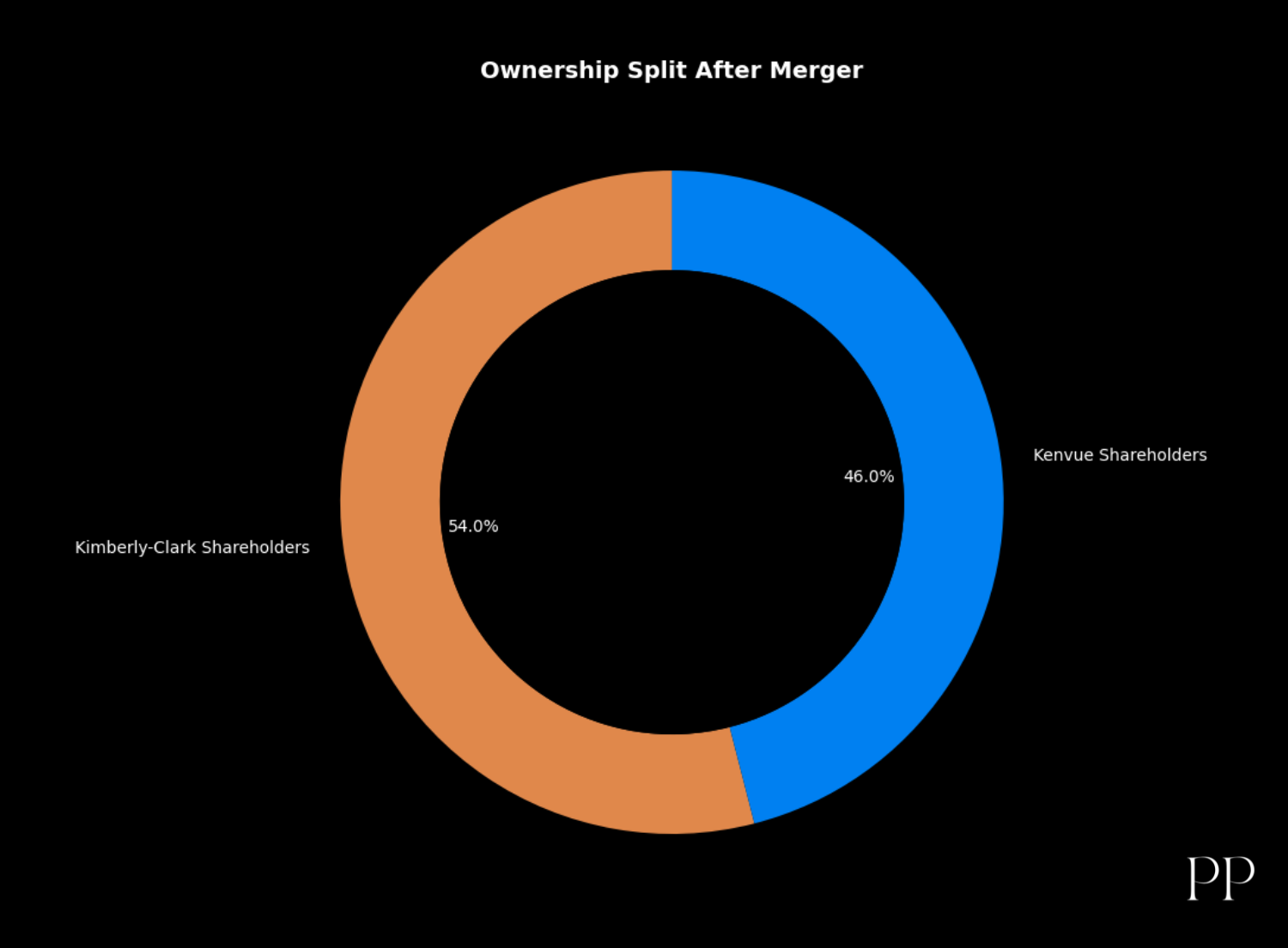

Upon closing, Kimberly-Clark shareholders are expected to own about 54% of the combined company, with Kenvue shareholders owning about 46%.

The transaction is subject to usual shareholder and regulatory approvals and is anticipated to close in the second half of 2026.

Why the Deal Makes Strategic Sense

- The combination brings together Kimberly-Clark’s strength in personal care and hygiene products (brands such as Kleenex, Huggies, Kotex) with Kenvue’s consumer health portfolio (brands including Tylenol, Band-Aid, Neutrogena, Listerine, Johnson’s Baby) — thus creating a global health & wellness leader.

- The combined company is projected to generate approx US$32 billion in annual revenue and about US$7 billion in adjusted EBITDA, based on current projections.

- Synergies: Kimberly-Clark estimates US$2.1 billion in run-rate synergies (about US$1.9 billion in cost synergies + ~US$500 million in revenue synergies) partially offset by ~US$300 million of reinvestment.

Potential Risks and Headwinds

- Kenvue has been navigating a challenging environment, including slowing organic sales, litigation risks, and consumer health product controversies

- Integrating two large companies with different cultures, geographies and portfolios always carries execution risk, particularly in realizing synergies and delivering promised cost savings.

- The deal’s premium is substantial: the offer implies a ~46 % premium over Kenvue’s recent share price. Some investors may question valuation given current headwinds.

Implications for Markets and Consumers

- For Kimberly-Clark: This is its largest acquisition to date, marking a bold pivot from its traditional tissue/hygiene business toward higher-growth consumer health and wellness.

- For Kenvue: The deal provides significant upfront value for its shareholders and an opportunity to participate in the upside of a larger combined entity.

- For consumers: The merger may lead to stronger brand combinations, more global scale, potential innovations in consumer health & hygiene, but also raises questions about competition, pricing, and innovation pace.

- For the industry: The acquisition signals that consolidation in the consumer health & personal care sector remains very much alive, even in times of economic uncertainty.

What to Watch

- How regulators respond: Given the global footprint and product overlaps, antitrust/competition and regulatory approvals will be key.

- Integration progress: Especially how Kimberly-Clark will merge Kenvue’s consumer health operations, brands and R&D into its structure.

- Financial performance: Whether the combined company delivers on the anticipated synergies and growth targets (e.g., the US$2.1 billion synergies).

- Impact on shareholders: For Kimberly-Clark’s existing shareholders, how the dilution and debt used to fund this deal will impact returns and credit profile.

- Brand and litigation risks: Kenvue’s portfolio includes brands with ongoing legal scrutiny (e.g., product safety, claims) — how these risks are managed will matter.

Conclusion

The acquisition of Kenvue by Kimberly-Clark is a high-stakes move: by bringing together two major consumer health and hygiene portfolios for nearly US$50 billion, the companies are betting on scale, brand strength and synergy to drive growth in a challenging global environment. If successful, it could redefine both companies’ place in the industry; if not, the premium paid and integration risks could weigh heavily. Either way, it’s a major strategic shift worth watching.