Wall Street’s $200 Billion Bet in Bonds for AI Infrastructure

Image Credit : Reuters

Source Credit : Portfolio Prints

Introduction

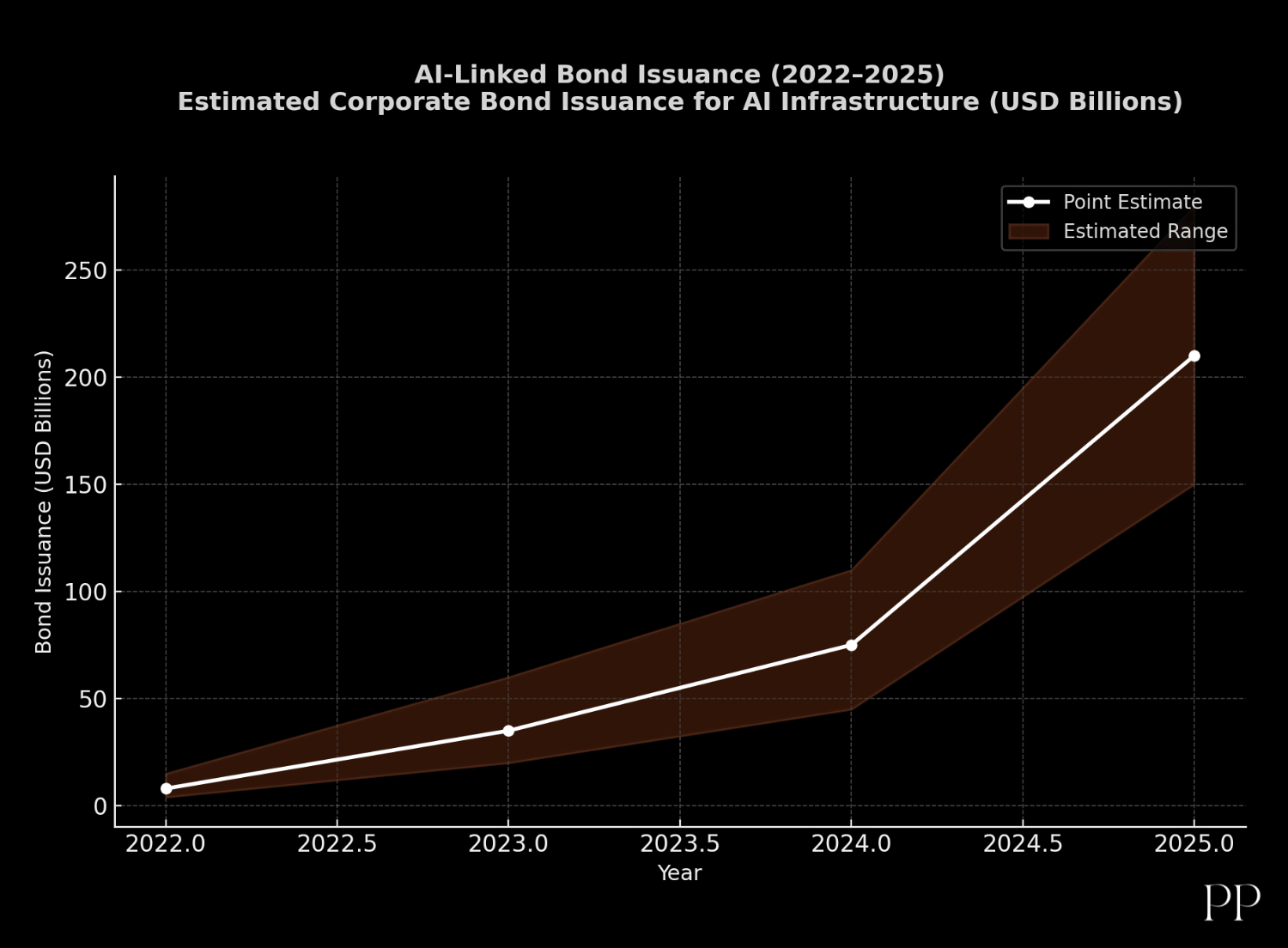

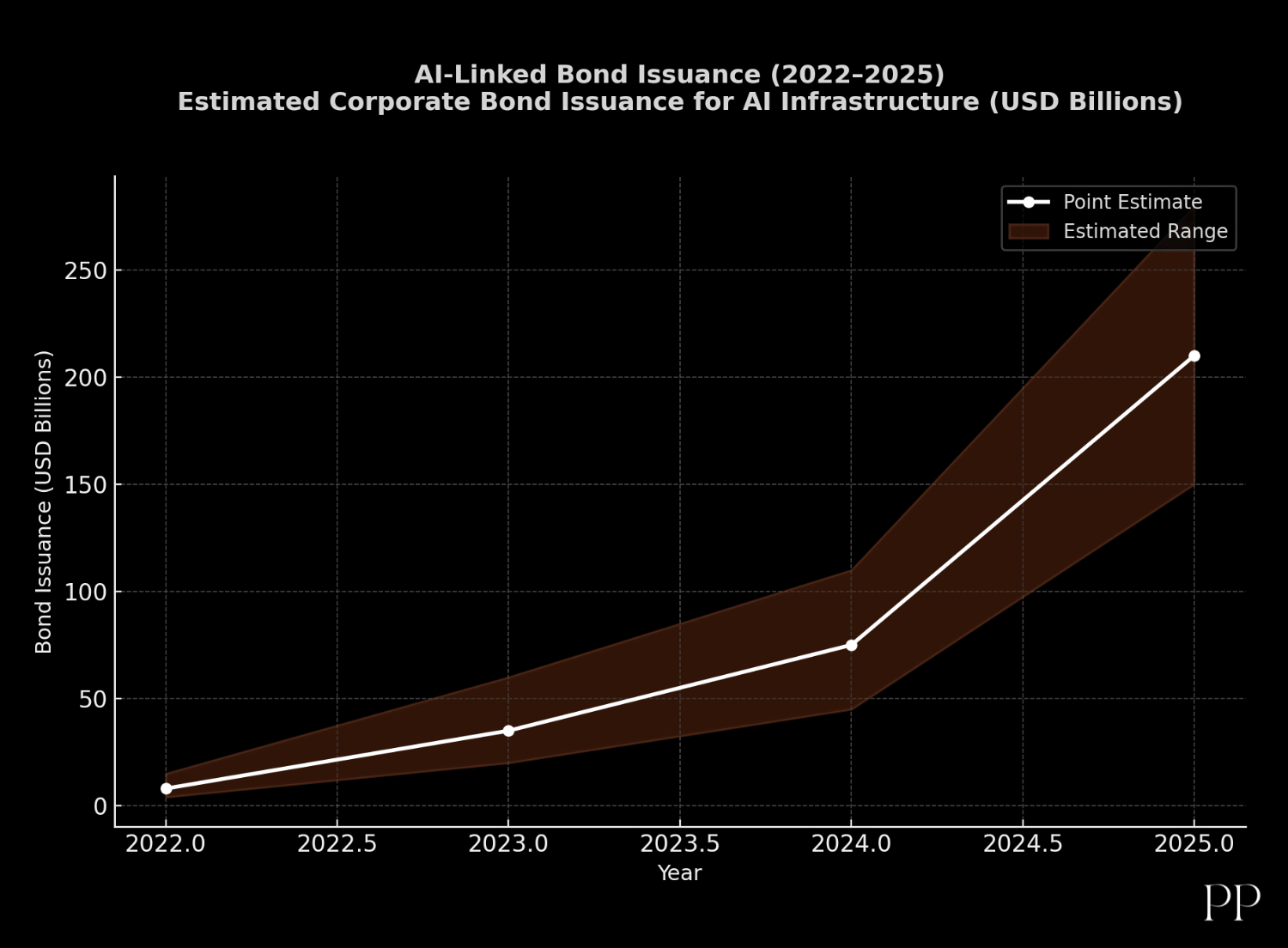

A striking development is underway in the credit markets: U.S. companies have issued over US$200 billion in bonds this year specifically to fund large-scale artificial-intelligence (AI) infrastructure projects. What began as tech firms financing growth through strong earnings and cash flows is now morphing into a debt-heavy build-out of data centres, hardware, and AI systems.

What’s happening

- According to the Financial Times, more than US$200 billion of corporate bond issuance in 2025 is tied to AI infrastructure spending.

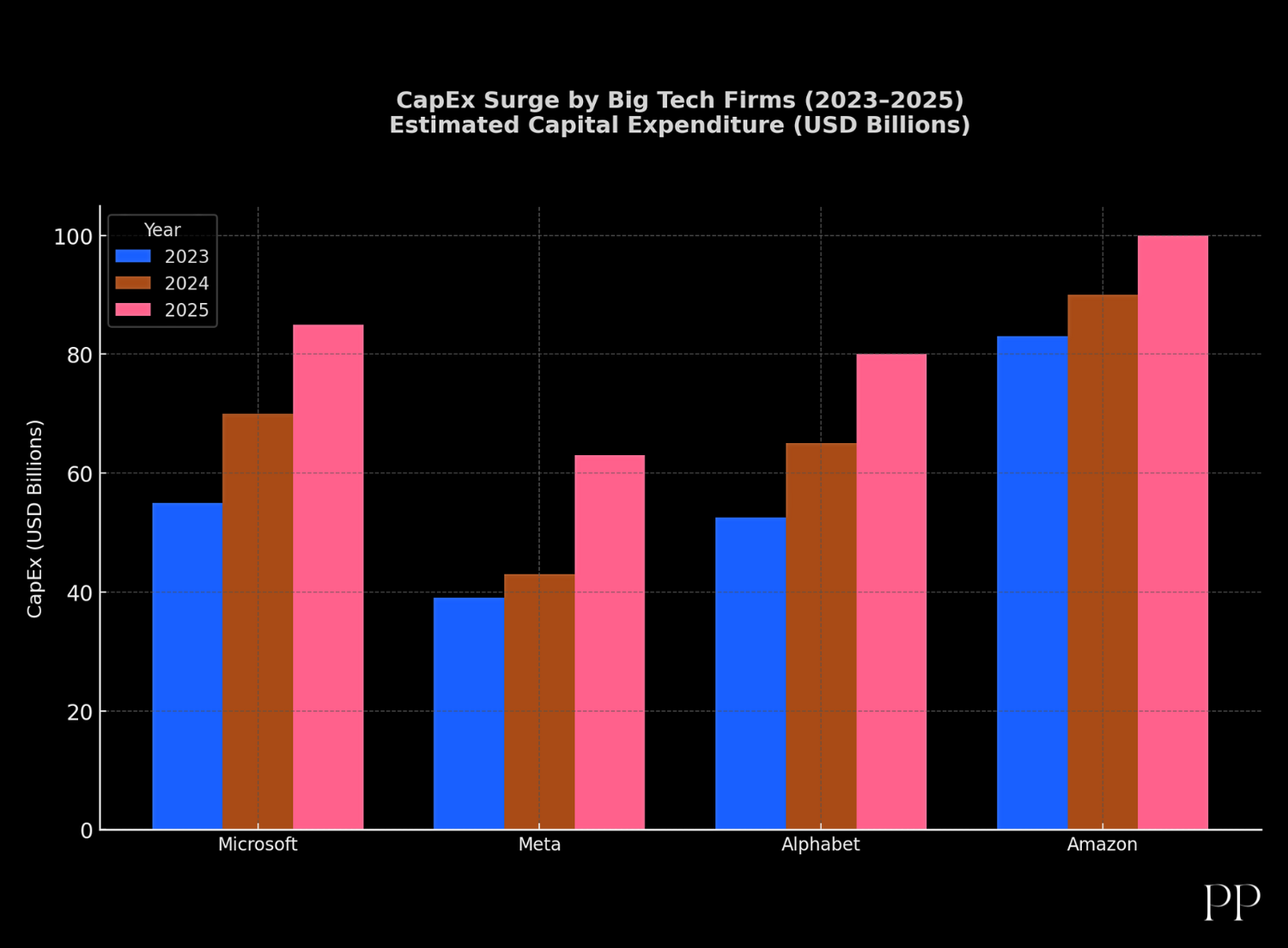

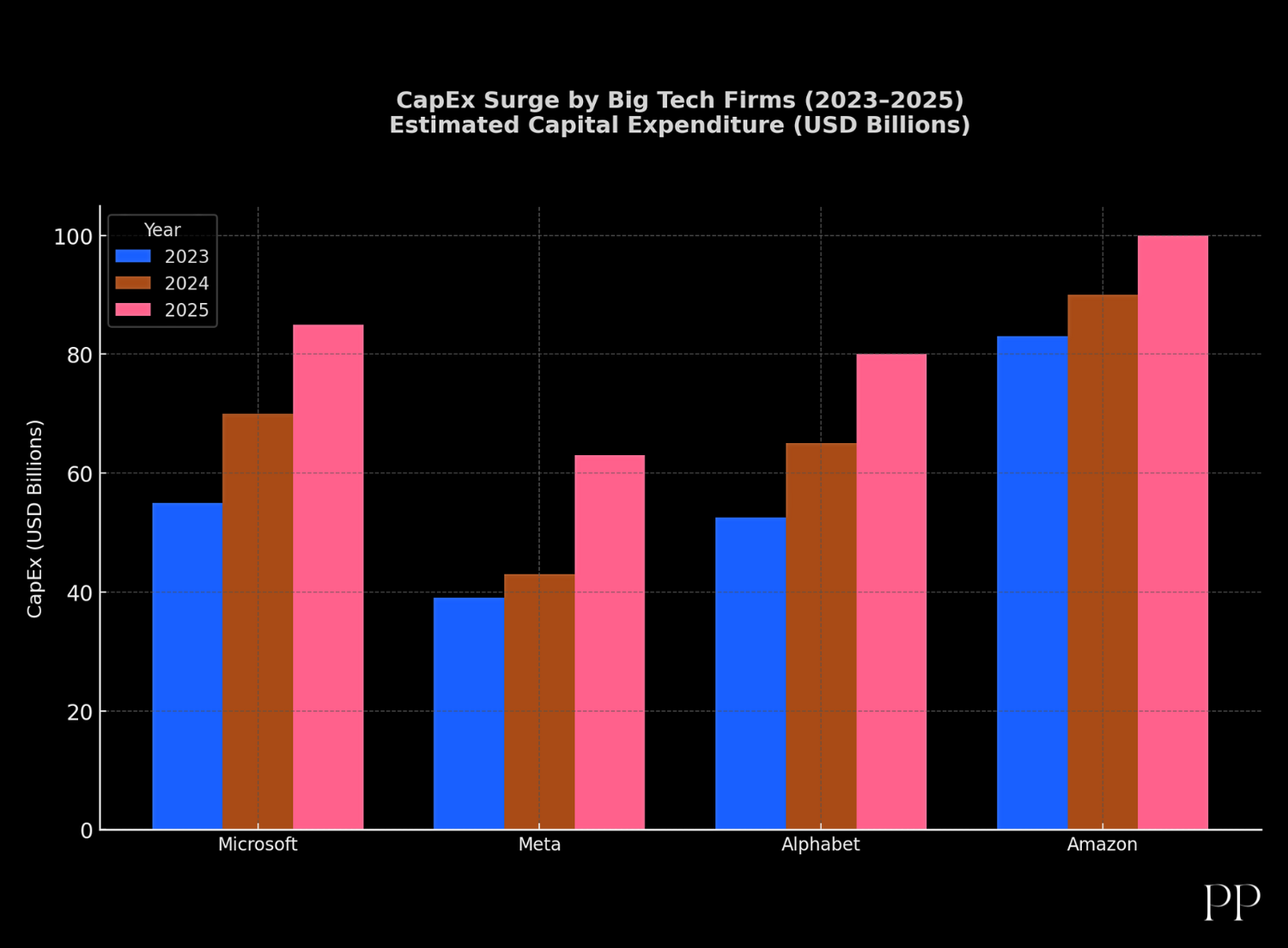

- Analysts at Citigroup estimate that “hyperscaler” tech firms will spend about US$490 billion on infrastructure and capital goods next year — up from previous estimates of ~US$420 billion.

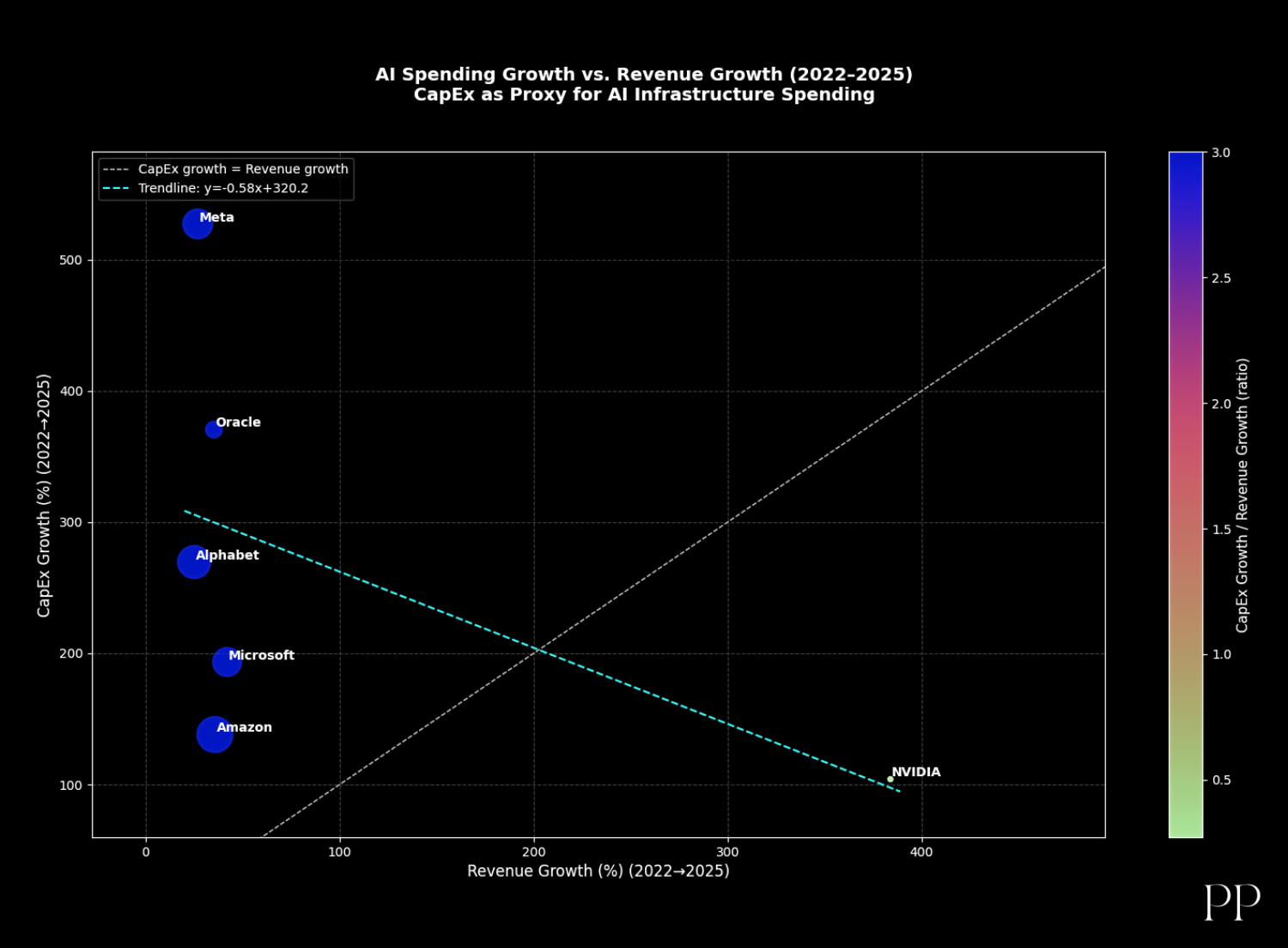

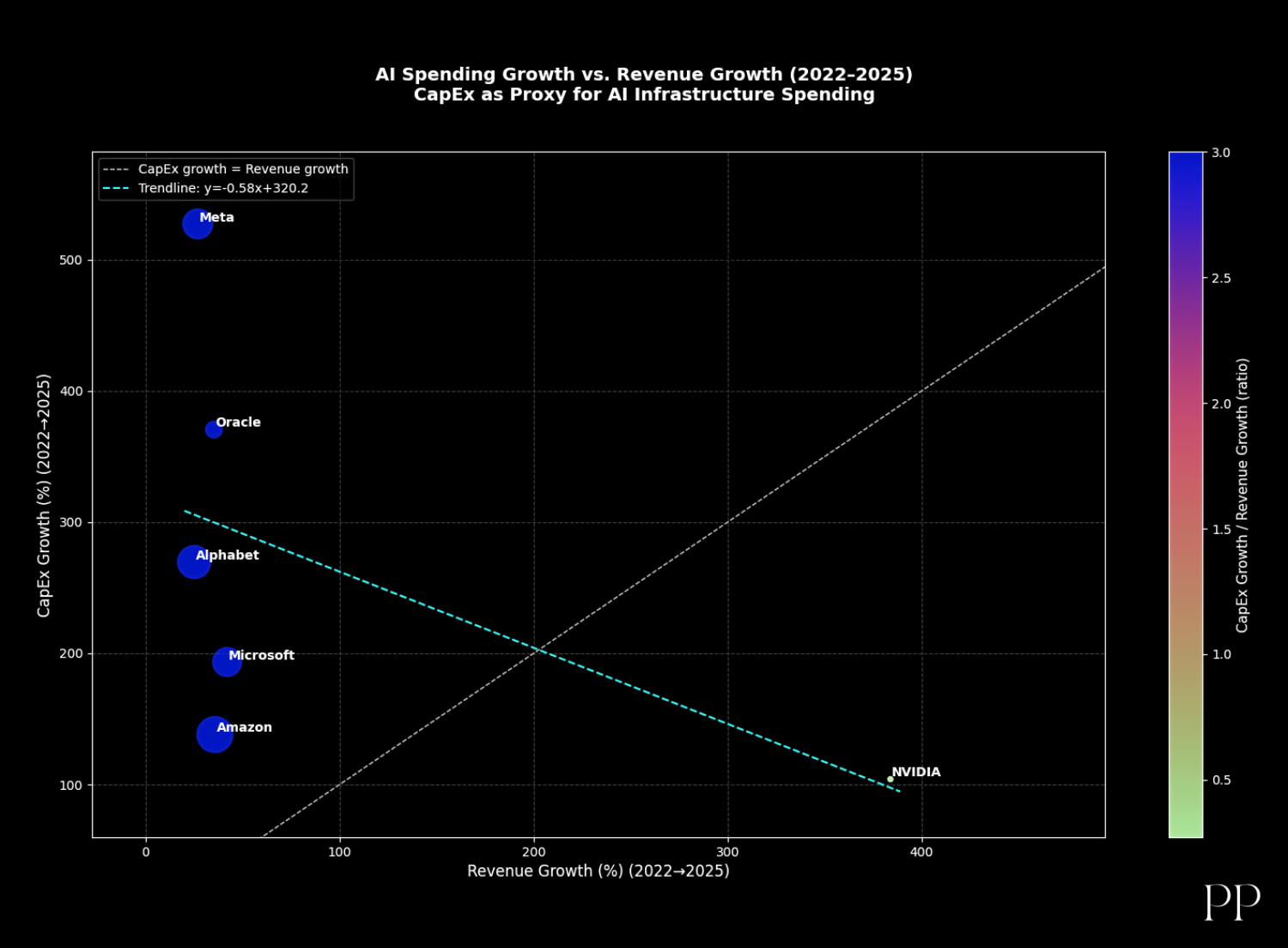

- The “big five” (such as Meta Platforms, Microsoft Corporation, Alphabet Inc., Amazon.com, Inc.) have signalled significant hikes in capital expenditure (capex) for AI & data centres.

- For example, Meta plans ~$70-72 billion in AI-related spending in 2025.

Why now?

- Scale of AI compute demand: The training and deployment of large language models, “foundation models”, edge & cloud AI etc., require vast data-centre capacity, networking, power, cooling. Investors and companies see this as foundational.

- Fear of being left behind: Tech firms feel they must “go all in” now on AI infrastructure, so as not to cede ground. Meta’s leadership has said they don’t want to under-invest.

- Shift from cash-funding to debt-funding: With capex requirements exploding, firms are turning more to bond markets rather than relying solely on internal cash flows. As noted by Citigroup analysts: “The AI data-centre build-out is increasingly being financed by debt rather than cash flows.”

- Flooded credit markets & investor demand: Investors have shown appetite for bonds tied to AI themes; some reports say these issuances are already a significant portion of new corporate debt.

Risks and concerns

- Return on investment (ROI) still uncertain: Many of these infrastructure investments have very long pay-back periods. If demand, model monetization, or market growth disappoints, the economics weaken. For instance, Meta’s stock dropped after announcing big capex increases — investors worried about margin erosion.

- Credit risk / bond risk: Bond issuance tied to AI means firms’ debt loads are rising. If cash flows or profitability don’t keep pace, credit quality could suffer. Analysts highlight this.

- Interest‐rate & duration risk: Bonds issued now with long maturities mean companies are exposed to higher interest cost and refinancing risk if rates rise or growth slows.

- Overcapacity / asset‐write-down risk: If too much infrastructure is built and the demand doesn’t match, companies may have under-utilised assets, leading to write-downs. Analysts note parallels to earlier tech build-outs (e.g., the dot-com or telecoms overbuild era).

- Market sentiment / bubble risks: Some investors worry that the hype around AI is inflating valuations and CapEx commitments beyond what fundamental returns warrant.

Implications for various stakeholders

- Investors: The explosion in AI-infrastructure financing means that tech-heavy portfolios may carry not just equity risk but also credit risk. Bond investors, especially in tech corporates, need to pay attention to the underlying debt backing infrastructure build‐outs.

- Corporations / tech firms: The choice between self-funding vs issuing debt is significant. If a firm over-commits relative to monetization, it may face margin squeeze or impaired cash flows. On the flip side, firms that scale efficiently may establish big competitive moats.

- Economy & sectors beyond tech: The infrastructure build-out has ripple effects — for data-centre real-estate, energy/utility demand, chip makers, cooling and power systems, etc. But if the build‐out mis-fires, sectors tied to these may face headwinds.

- Credit markets / financial stability: With a big chunk of corporate debt tied to this AI theme, weaknesses in performance or cash flows could generate broader stress in corporate credit. Some analysts caution that a “flood” of AI-related issuance is happening.

The takeaway: Opportunity with caution

The story of “$200 billion in bonds for AI infrastructure” signals a defining moment: the AI era is moving from hype to massive physical build-out — data centres, compute farms, networks, servers. But while the scale is huge, the path to returns is still unproven.

For firms and investors, this is a strategic bet: invest early, scale fast, and hope that AI monetization follows. But it’s also a speculative bet: if AI growth lags, or if hardware & infrastructure become over-built, the debt and cost burdens will bite.

Conclusion

The headline “Wall Street’s US$200 billion bet in bonds for AI infrastructure” captures both the scale and the transformation underway. It’s a major evolution in how the technology sector is financed — leaning heavily on debt, quite unlike past cycles. That shift brings the potential for accelerated growth but also magnified risk.

For stakeholders from investors to tech firms, the message is: this is a high-stakes game. The infrastructure is being built now, the costs are committed now, and the returns will come (if they come) over years. The winners may establish dominant platforms; the losers may bear heavy debt loads for under-utilised assets.