Source Credit : Portfolio Prints

What’s happening

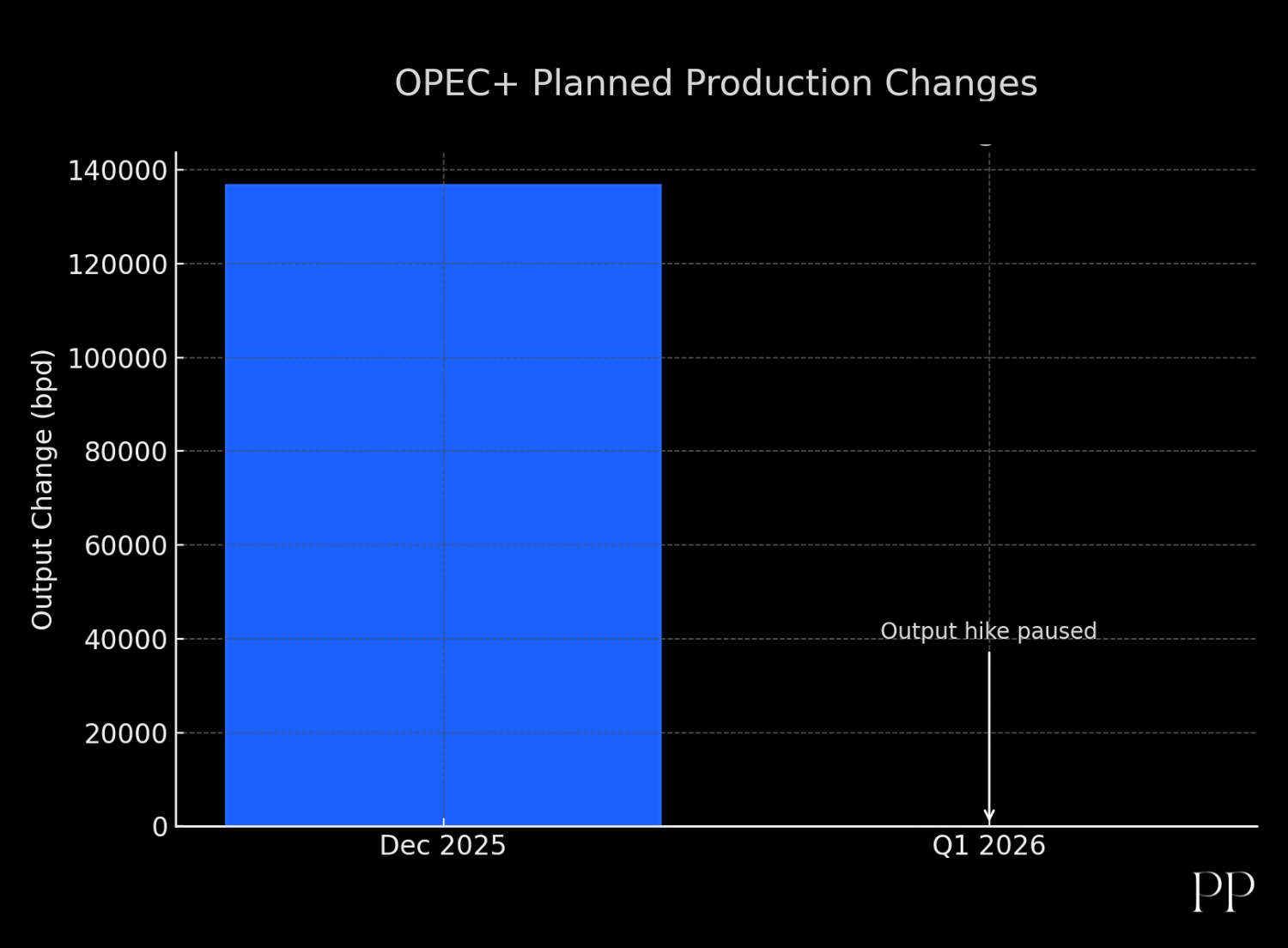

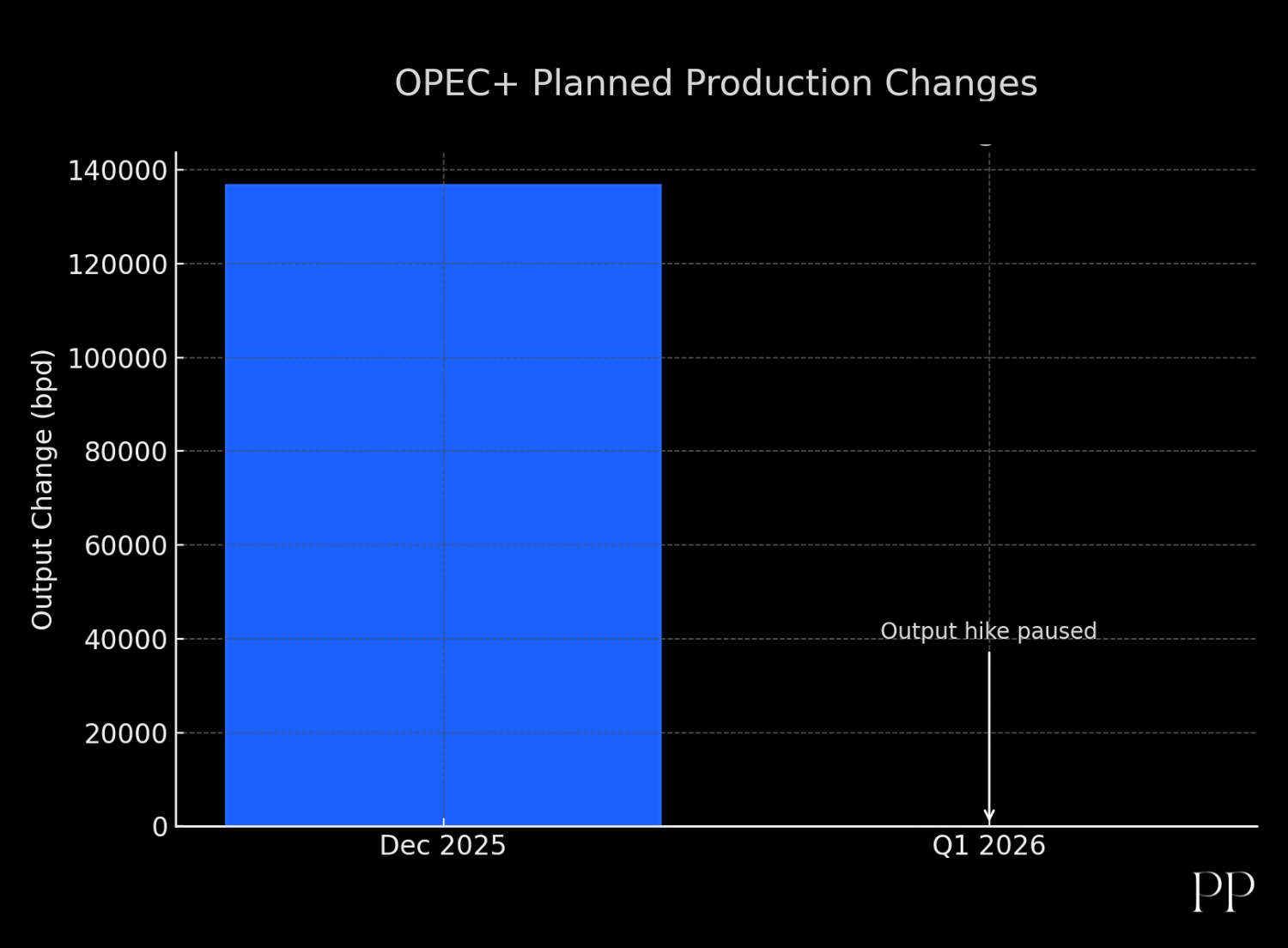

The oil market is jittery. Recently, OPEC+ announced a modest increase in production for December, followed by a pause in further hikes through the first quarter of 2026.

- The group approved roughly an additional 137,000 barrels per day (bpd) for December.

- After that, the production target will remain unchanged during Q1 2026, according to internal strategy discussions.

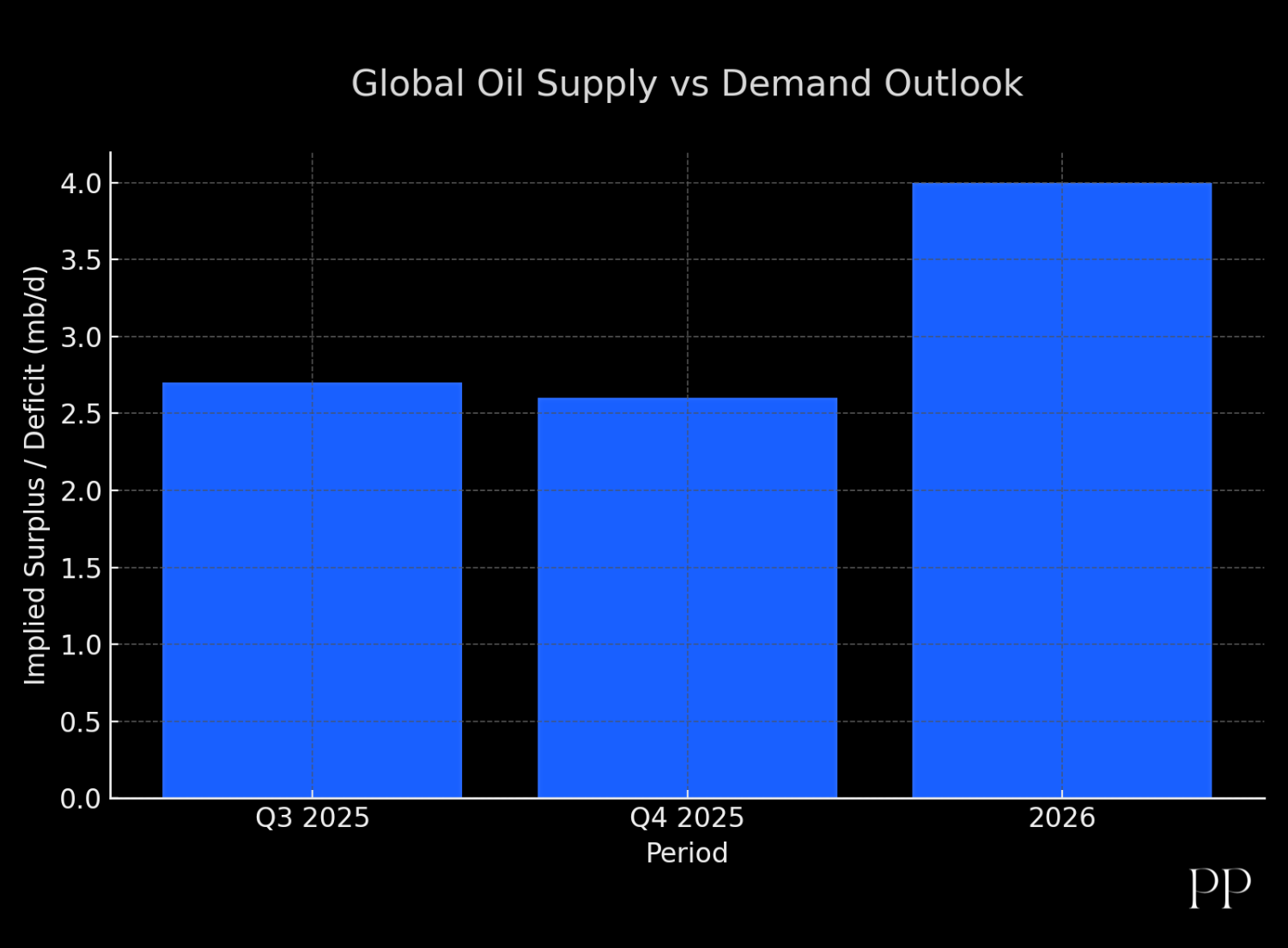

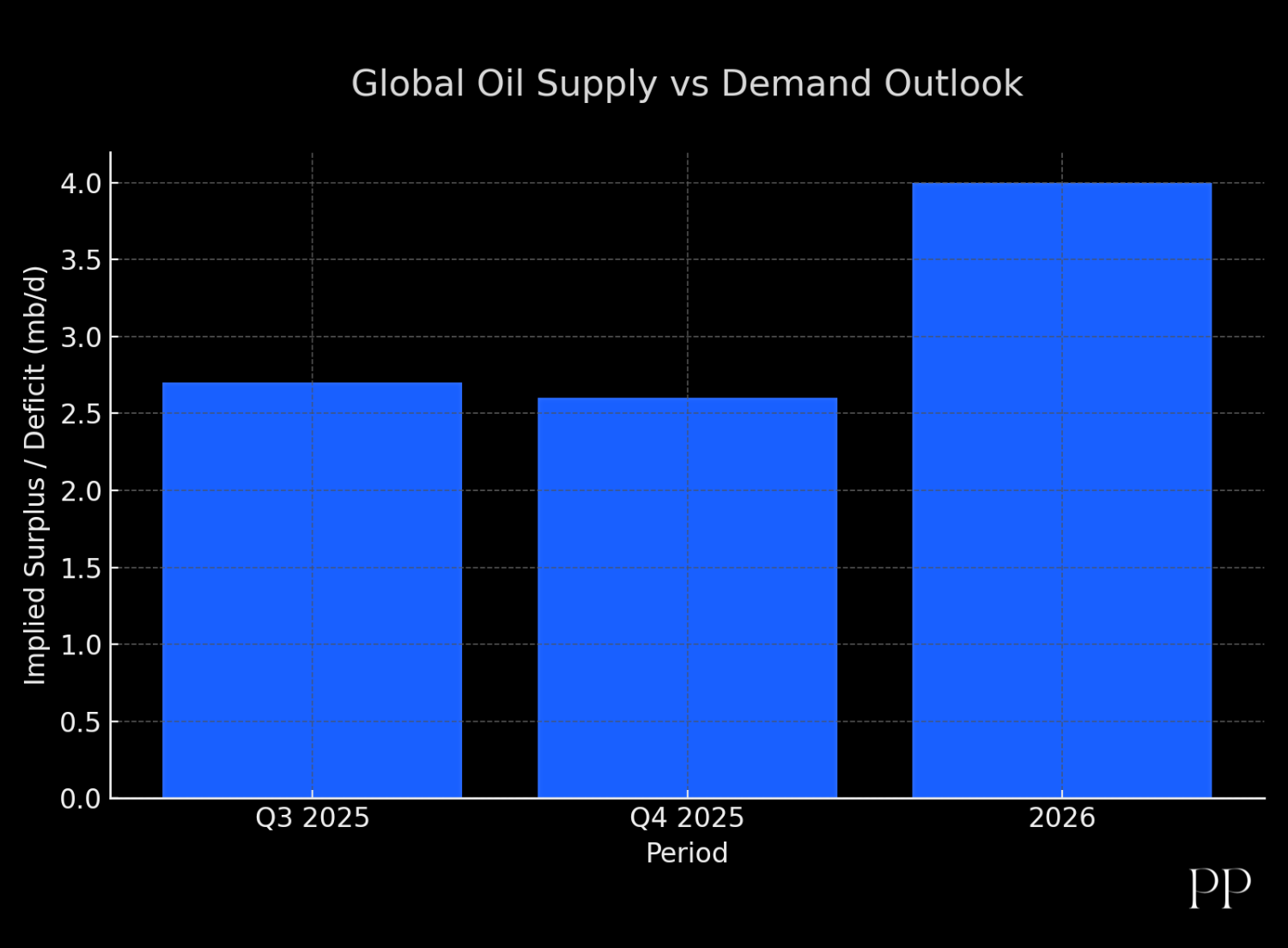

- This cautious approach comes amid concerns that oil supply could outstrip demand and inventories may build up.

Why it matters

Supply-side signals matter a lot

OPEC+’s production strategy has a strong signalling effect. The decision to lift production slightly but then pause suggests the group is aware of both the need to maintain market share and the risk of oversupply.

When supply appears to be increasing (or set to increase) while demand is weak or uncertain, that tends to exert downward pressure on prices — or at the very least increase volatility.

Demand is soft/uncertain

Global demand growth is weaker than hoped in some regions, and the risk of a supply glut is front and centre in analysts’ minds. For example, one forecast sees International Energy Agency (IEA) expecting only ~0.7 million bpd of demand growth in 2026 which could leave a surplus.

Inventories and non-OPEC production are rising

Non-OPEC producers (not in the OPEC+ alliance) continue to expand output, and inventories look likely to build unless demand picks up strongly.

Market behaviour reflects this balancing act

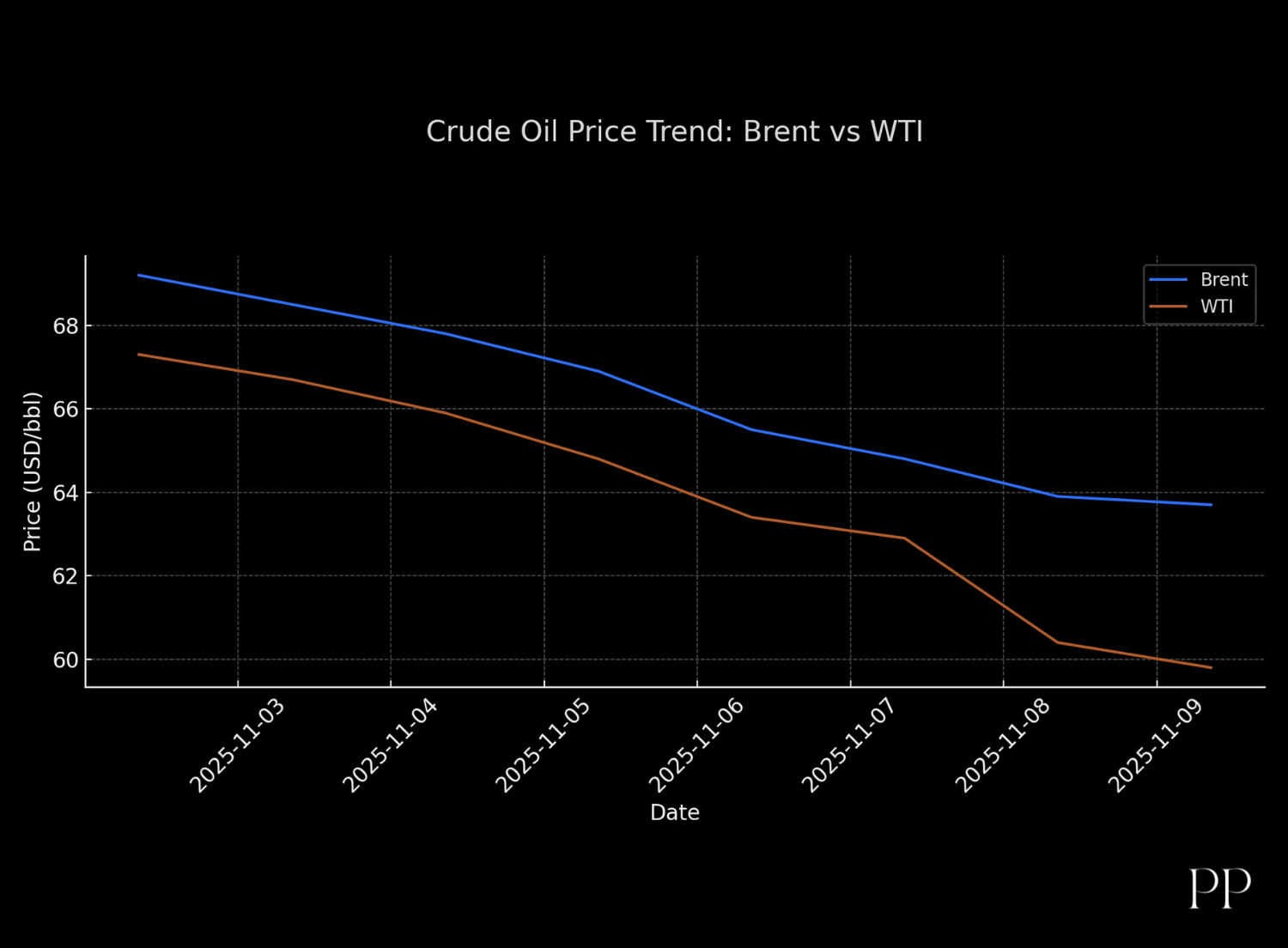

Prices of benchmarks such as Brent crude oil and West Texas Intermediate (WTI) are range-bound, reflecting uncertainty rather than certainty of strong trend.

Because many variables (supply, demand, geopolitics) are pointing in conflicting directions, traders are jittery and appear to be shifting positions accordingly.

Key Themes & Interpretations

Modest increase + pause = attempt at stability

The modest December hike suggests OPEC+ wants to signal some flexibility (i.e., not locking in deep cuts indefinitely) but the pause shows caution: avoid flooding the market still recovering from earlier shocks.

“Balance” is the keyword

Rather than trying to engineer a big price rise, many analysts believe the group is trying to maintain a stable price band and avoid large swings.

Risk of “too much supply, too little demand” looms

If supply continues to grow and demand disappoints, the pause may merely delay a correction rather than prevent it. For instance, one Indian market commentary suggests Brent could soften to ~$60/barrel and WTI to the high-$50s by year-end.

Geopolitics still matter

While supply decisions dominate, external factors like sanctions (e.g., on Russian oil exports) or disruptions (export terminal damage) remain wildcards. Those supply disruptions could tilt the balance back toward tighterness and higher prices.

Outlook & What to Watch

- Upcoming inventory data (e.g., from the American Petroleum Institute (API) and the U.S. Energy Information Administration (EIA)) — rising stockpiles will reinforce oversupply concerns.

- Demand data from major consumers — especially China, India and key economies in Europe; softness here could weigh heavily.

- Geopolitical developments — sanctions, conflicts in oil‐producing regions, export disruptions: any unexpected shock may offset oversupply risks.

- Further OPEC+ statements — Watch for language about next year’s output plans, compliance by members, and any signals of deeper coordination or divergence.

- Non-OPEC supply growth — U.S., Brazil, and others may ramp up output; if so, the spare‐capacity cushion may shrink or be exhausted faster than expected.

- Price levels — Many analysts see a scenario where Brent drifts toward ~$60/barrel if oversupply dominates; a supply disruption, on the other hand, could give upside surprise.

Conclusion

The latest move by OPEC+—a small production increase for December followed by a planned pause in output growth in Q1 2026—is a clear signal that the group is navigating a delicate balance between supply and demand, recognition of slower growth, and broader market uncertainty.

For the oil market, the effect is heightened volatility and a sense that the “next move” depends less on dramatic policy shifts and more on how the interplay of demand, supply, inventories and geopolitics plays out. The pause may stabilise sentiment in the short run, but it doesn’t remove the risk of downside if demand disappoints or supply from non-OPEC rises faster than thought.