Source Credit : Portfolio Prints

Why Central Banks Are Warning

In the latest round of financial stability assessments, a number of major central banks have issued cautionary signals. For example, the European Central Bank (ECB) in its November 2025 Financial Stability Review warned that “stretched valuations” in asset markets — particularly in equities and tech stocks — could be vulnerable to sharp corrections.

The ECB also identified elevated risks arising from global factors such as tariff uncertainties, elevated government debt in some advanced economies, and the possibility of rapid “price adjustments” in various markets — events that could undermine investor confidence and ripple through financial systems.

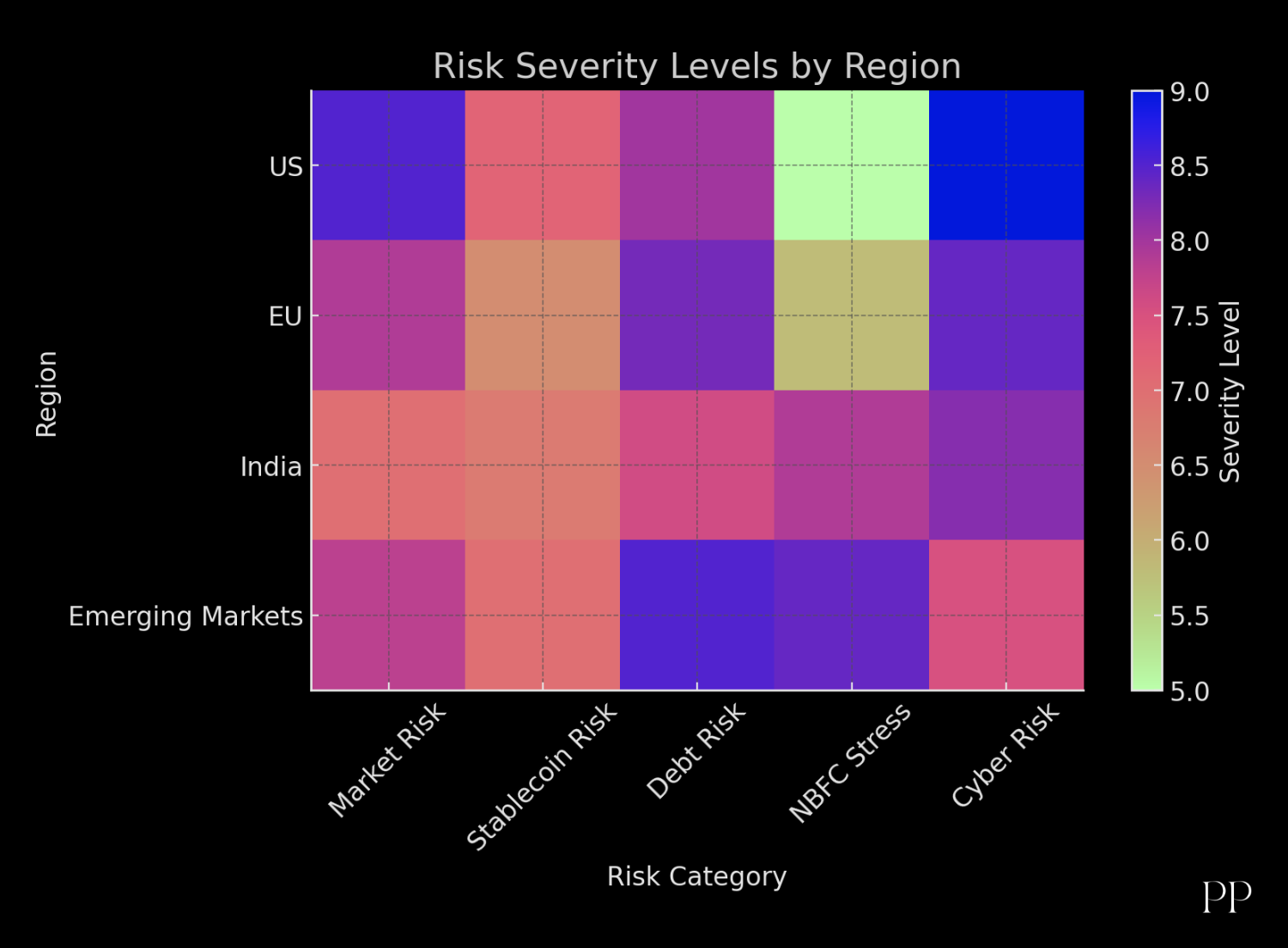

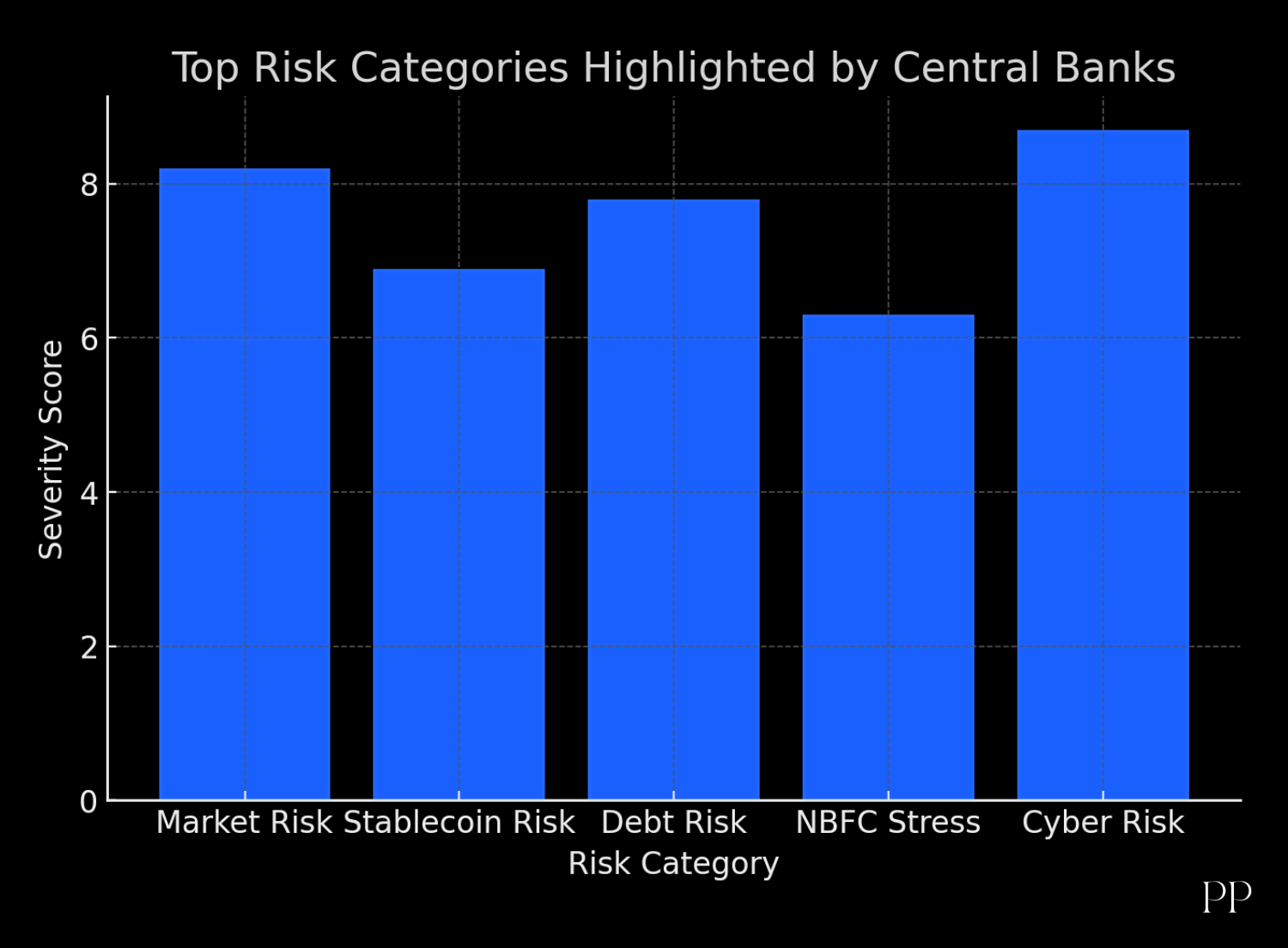

Parallel to these concerns, global regulators and central banks are flagging newer, less-traditional threats. The growing prevalence of digital assets — especially stablecoins — has emerged as a recurring theme in warnings from institutions worldwide.

Finally, many central banks are also mindful of broader macroeconomic and structural risks: global spillovers from geopolitical tensions and trade conflicts, climate change, cyber-threats, and the evolving nature of liquidity in a post-pandemic, high-interest rate environment.

What Are the Key Vulnerabilities Highlighted

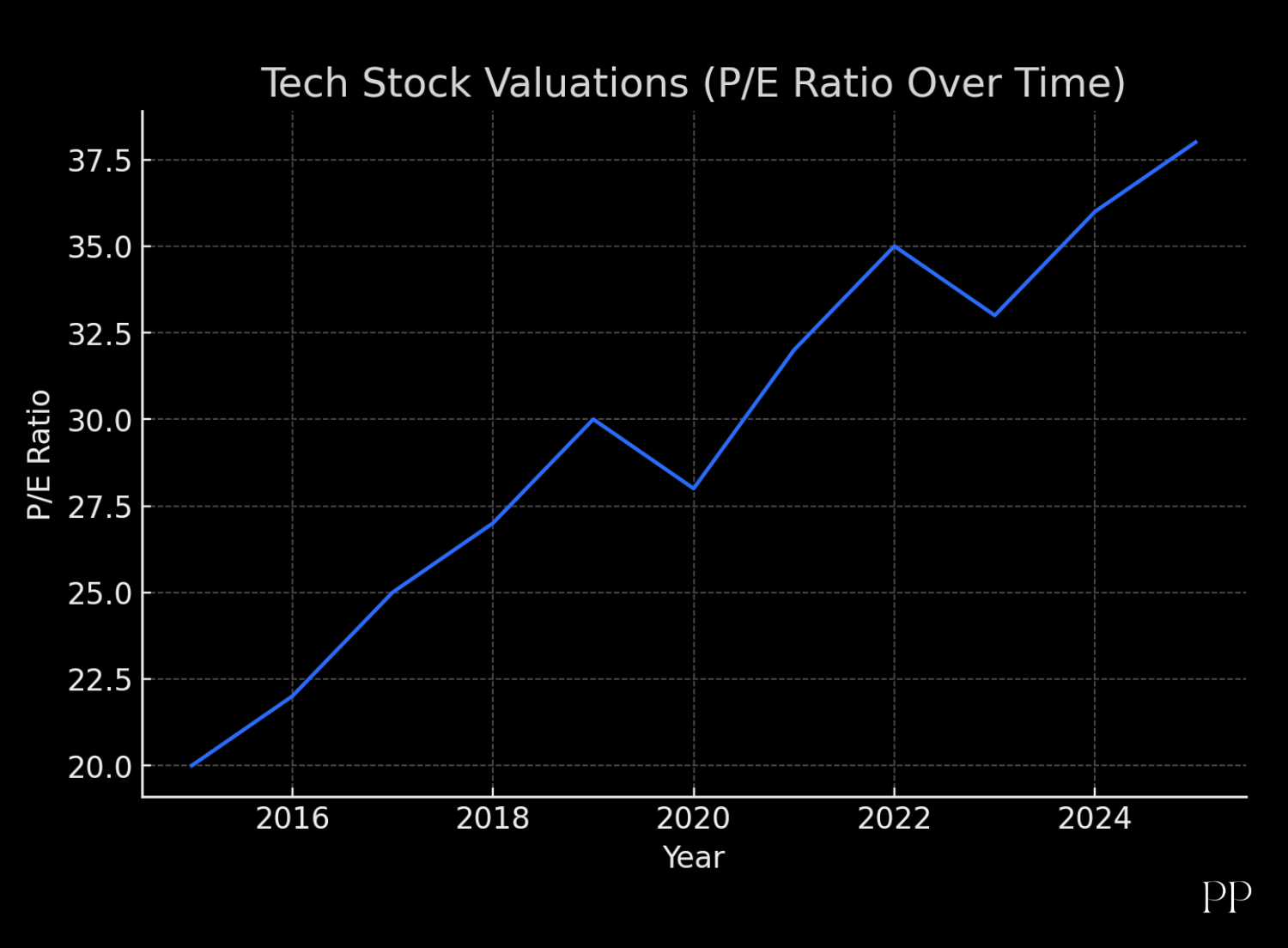

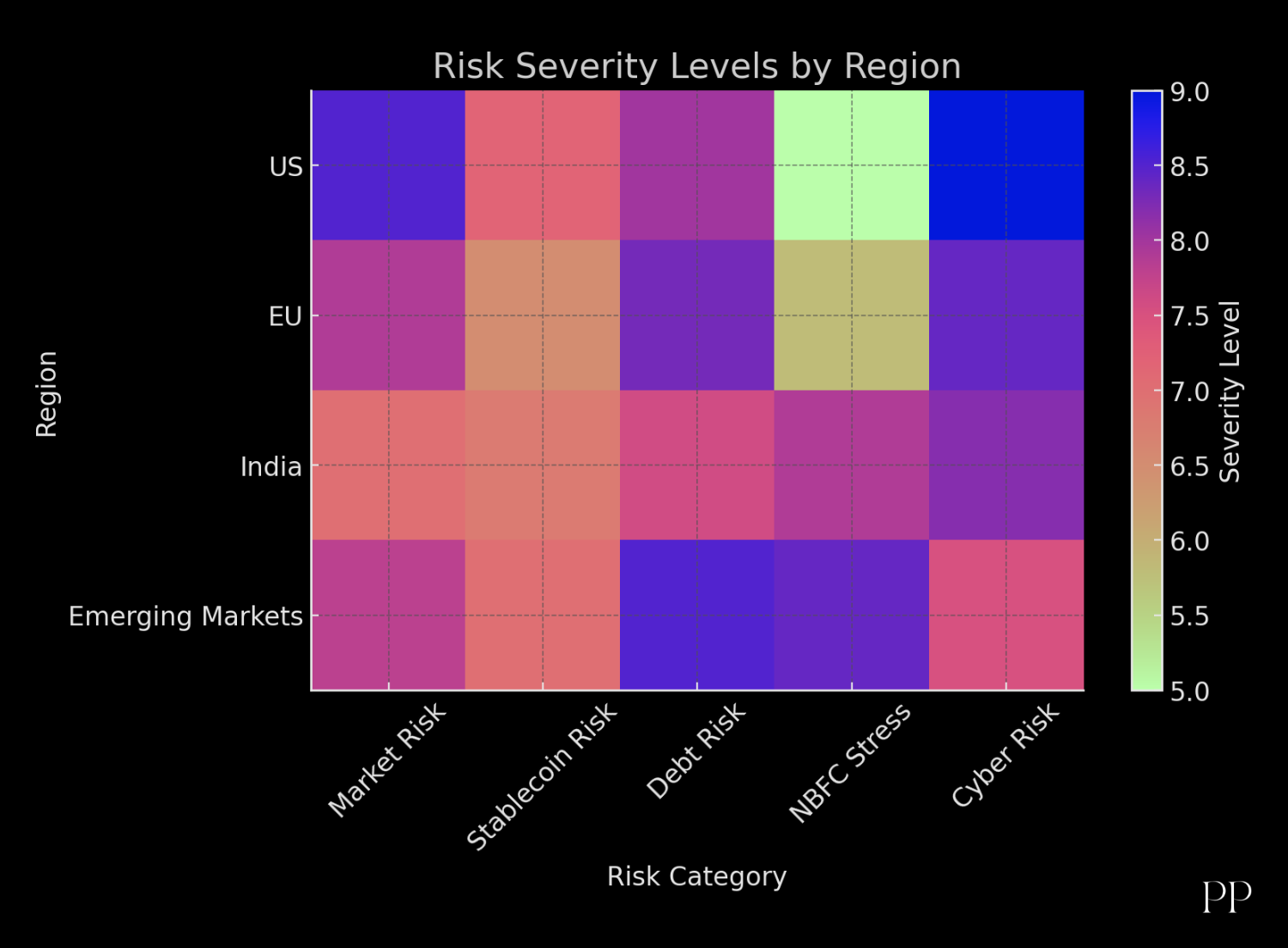

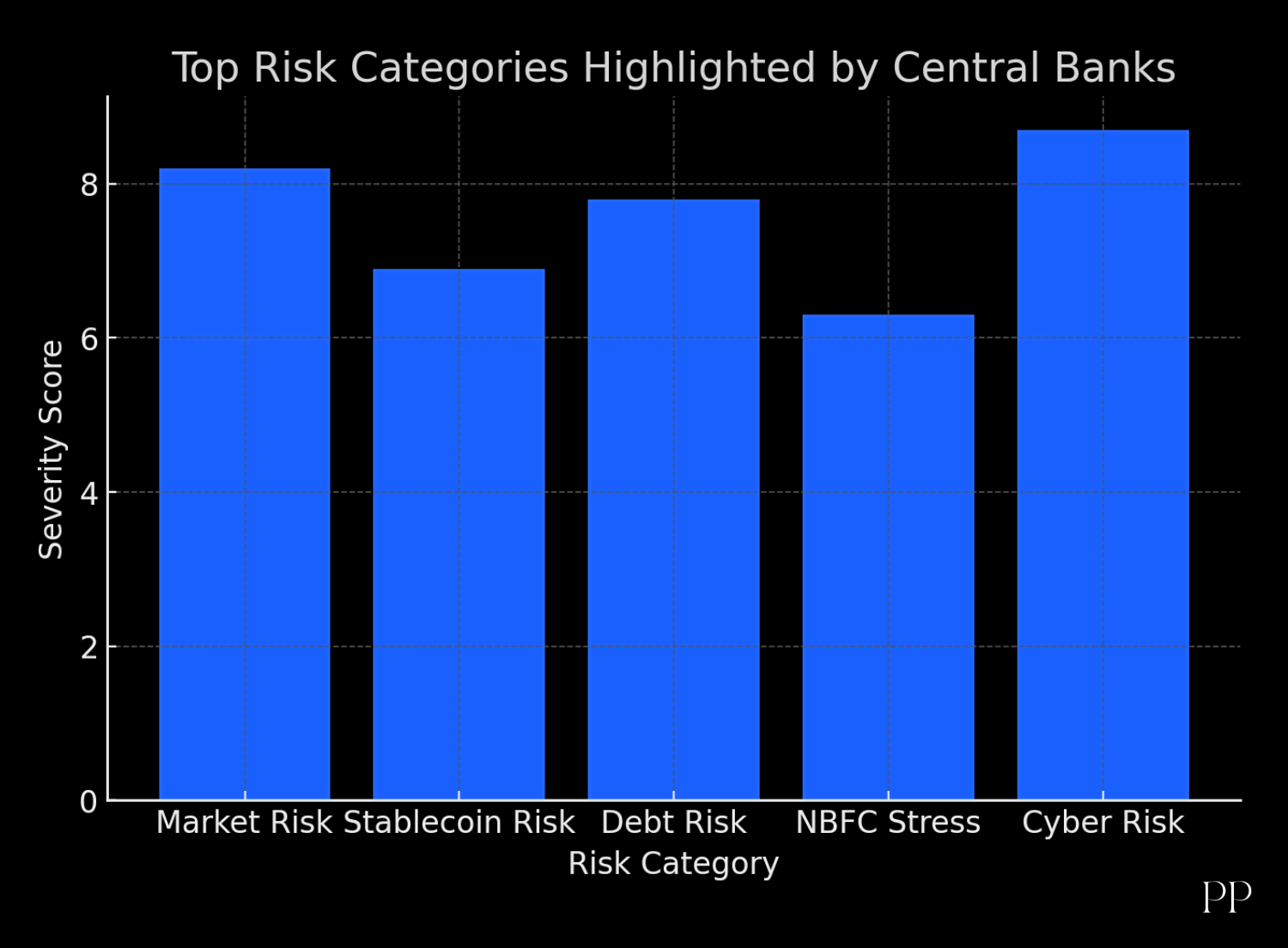

Overvalued Markets & Investor Euphoria

The ECB noted that equity markets — especially in sectors like technology — appear overly optimistic, possibly driven by a “fear of missing out” (FOMO) regarding future gains (e.g. from artificial intelligence). This optimism might not be justified by fundamentals. If sentiment shifts, valuations could plunge, affecting not only investors but also institutions holding these assets.

Risks from Digital Assets & Stablecoins

Critically, banks are now warning that stablecoins and other digital-asset instruments could undermine traditional banking. For instance:

- The ECB recently cautioned that stablecoins might siphon off deposits from banks in the eurozone, weakening traditional funding structures.

- A sudden wave of redemptions (in the event of a crisis of confidence) could force issuers to sell large holdings — potentially destabilizing money-market and Treasury markets, especially in the U.S.

- Some central banks — including those in emerging economies — are raising alarms about the lack of regulation around stablecoins, and the risk of systemic contagion if stablecoins grow unchecked.

External Spillovers: Trade, Debt, Geopolitics, Climate & Cyber Risk

Beyond markets and new-asset classes, traditional macroeconomic threats remain. For instance:

- Trade tensions and tariff uncertainties could undermine growth and investor confidence, especially in regions heavily connected through trade.

- High public debt in some advanced economies may stress global bond markets and lead to disruptive capital flows, currency instability or sudden interest-rate shifts.

- Climate change, cyber threats, and technological dependency — especially as financial systems become more digitized — are increasingly viewed as structural risks. Some regulators now point to governance, operational resilience and oversight as key to long-term financial stability.

Contagion Risk in Non-Bank Segments (e.g. NBFCs, non-bank financial institutions)

Even countries with “strong” banking sectors are not immune. Take the Reserve Bank of India (RBI): while it recently stated that Indian banks remain well-capitalized with healthy buffers, it nonetheless flagged growing stress in the non-bank financial company (NBFC) sector as a potential source of contagion risk.

This bifurcated stability — where banks are strong but non-bank financial firms are vulnerable — underscores how risks can build outside traditional banking channels, yet spill back into the broader financial system.

What Could Trigger a Crisis

According to central banks and financial regulators, the combination of these risks means the global financial system is increasingly vulnerable to “snowballing” events. Some potential triggers include:

- A sharp global growth slowdown or recession — perhaps triggered by geopolitical conflict, trade wars, or a slump in major economies — could deflate risky asset valuations.

- A loss of confidence in stablecoins or a major default among stablecoin issuers — leading to mass redemptions and pressure on money-market instruments or even sovereign bond markets.

- Sudden tightening of liquidity, e.g., from rising interest rates or sudden shifts in capital flows triggered by macroeconomic or geopolitical events.

- Operational failures or cyber-attacks, especially as banking and financial systems become more reliant on digital platforms and common infrastructure.

- Spillover effects from stressed NBFCs or non-bank financial entities that have high leverage or interconnected exposures — even if traditional banks remain well-capitalized.

If these or similar triggers materialize, the fallout could be severe: losses for households, companies, and banks; liquidity crunches; tighter lending; and broad economic slowdown.

What Regulators and Policymakers Are Doing

In response to these risks, several steps are being advocated or already implemented:

- Maintain strong capital buffers and enforce liquidity requirements for banks (so they can absorb shocks). The ECB explicitly suggested retaining existing capital buffer requirements.

- Heighten monitoring of non-bank financial institutions (NBFCs, funds, fintech firms) to avoid risk concentration and contagion outside traditional banks. As the RBI noted, stress in NBFCs must be tracked closely.

- Strengthen regulation of digital assets, stablecoins, and crypto-related products to safeguard against destabilizing flows, runs, or liquidity shocks. As per ECB and other central banks’ warnings.

- Improve institutional resilience — including governance practices, cyber-security frameworks, and crisis-management tools — especially in an increasingly digitized financial architecture.

- Encourage diversification of funding sources and avoid over-reliance on a narrow set of markets (e.g. high-risk assets or volatile funding).

For emerging economies, an added emphasis should be on contingency planning, stress testing under adverse global scenarios, and reinforcing regulatory oversight — both for banks and non-bank financial intermediaries.

Conclusion

The recent warnings from major central banks reflect a broad consensus: the global financial system is navigating a period of heightened risk. Between overvalued markets, structural shifts with digital assets, global debt burdens, macroeconomic uncertainty, and evolving financial interconnections — the potential for shock has arguably never been higher since the post-pandemic recovery.

That said, these are not immediate panic signals. In many economies, banking systems remain relatively healthy, regulatory oversight is stronger than before, and stress-testing suggests resilience under many adverse scenarios (although not all).

But perhaps the most valuable takeaway — from India’s standpoint and globally — is this: stability is no longer a default. It must be actively preserved through prudent regulation, vigilant oversight, and preparedness for the unexpected.